lincoln ne sales tax increase

A coalition of community leaders today said a quarter-cent sale tax for streets is needed to keep Lincoln strong and growing. The Nebraska state sales and use tax rate is 55 055.

Lincoln On The Move City Of Lincoln Ne

This hotel is located in a city with a 175 city.

. Leading up to the election the sales tax rate in Lincoln Nebraska was 7 percent. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent.

Over the past year there have been eighteen local sales tax rate changes in Nebraska. 2022 Nebraska Sales Tax Changes. This table lists each changed tax jurisdiction the amount of the.

In the event you need to defend your position in the court it may make. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. You can print a 725 sales tax table here.

In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. It was a close vote.

There are sales tax rates for each state county and city here. The current total local sales tax rate in Lincoln NE is 7250. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. Upon approval by a majority of voters in any city county or state general primary or special election.

The group is asking the City Council to place on the April 9 primary. You can print a 725 sales tax table here. The Nebraska state sales and use tax rate is 55 055.

What happens when voters elect to start change or terminate a local sales and use tax. This included the statewide sales tax rate of 55 percent and the additional citywide rate of 15. What is the sales tax rate in Lincoln Nebraska.

The Nebraska state sales and use tax rate is 55 055. 025 lower than the maximum sales tax in NE. There is no applicable county tax or special tax.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. Lincoln is the capital city of the us. The December 2020 total local sales tax rate was also 7250.

Lincoln Ne Sales Tax Increase. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

This is the total of state county and city sales tax rates. The lincoln city council still has to vote on whether to ask voters to raise the sales tax to 175 percent. Lincolns City sales and use tax rate increase.

Lincoln voters approved the 14-cent increase in April. The push for raising the local sales tax in Lincoln started when a coalition of 27 community leaders were convened and met for months said Miki Esposito Lincolns public works director. The posted rules should show how you can appeal the countys judgement at the state level if you think it is still incorrect.

/cloudfront-us-east-1.images.arcpublishing.com/gray/GAN5CWJIAFGV5LYYD6342D4OBU.png)

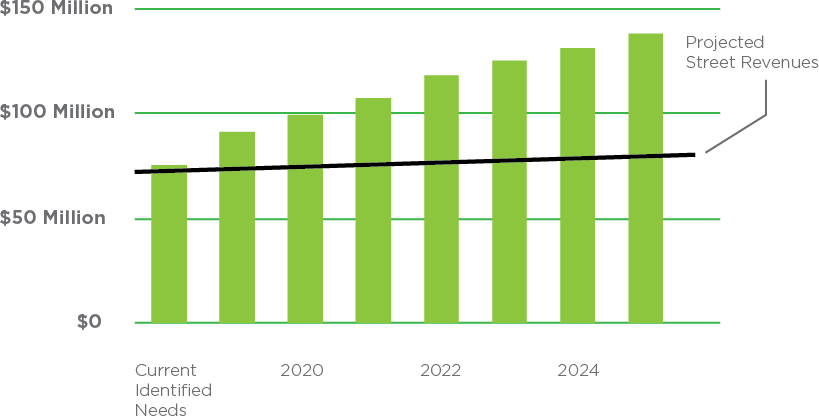

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

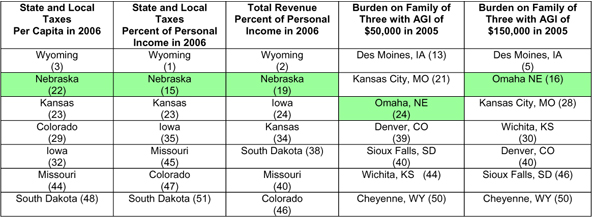

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Top 10 U S Metros Where Cash Home Sales Are On The Rise Attom

Lincoln To See New Sales Tax Revenue Starting October 1

Lincoln Ne Gov Transportation And Utilities Projects

Lincoln Journal Star From Lincoln Nebraska On January 21 2018 B1

Nebraska Group Recommends Eliminating Some Sales Tax Breaks

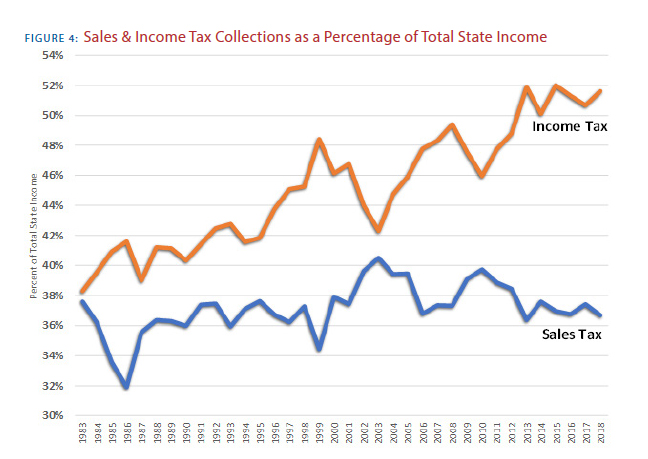

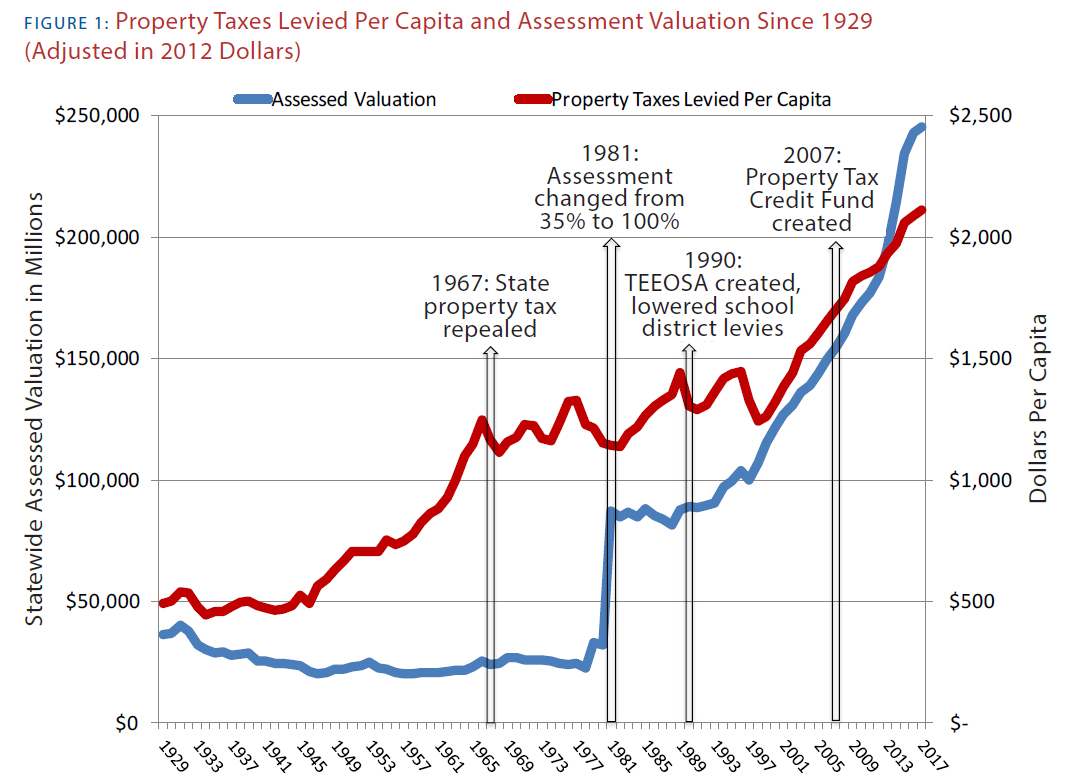

Taxes And Spending In Nebraska

Sales Tax Increase Could Generate 78 Million For Lincoln Streets Kfor Fm 103 3 1240 Am

City Sees Increase In July Sales Tax Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/GAN5CWJIAFGV5LYYD6342D4OBU.png)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

Lotm Frequently Asked Questions City Of Lincoln Ne

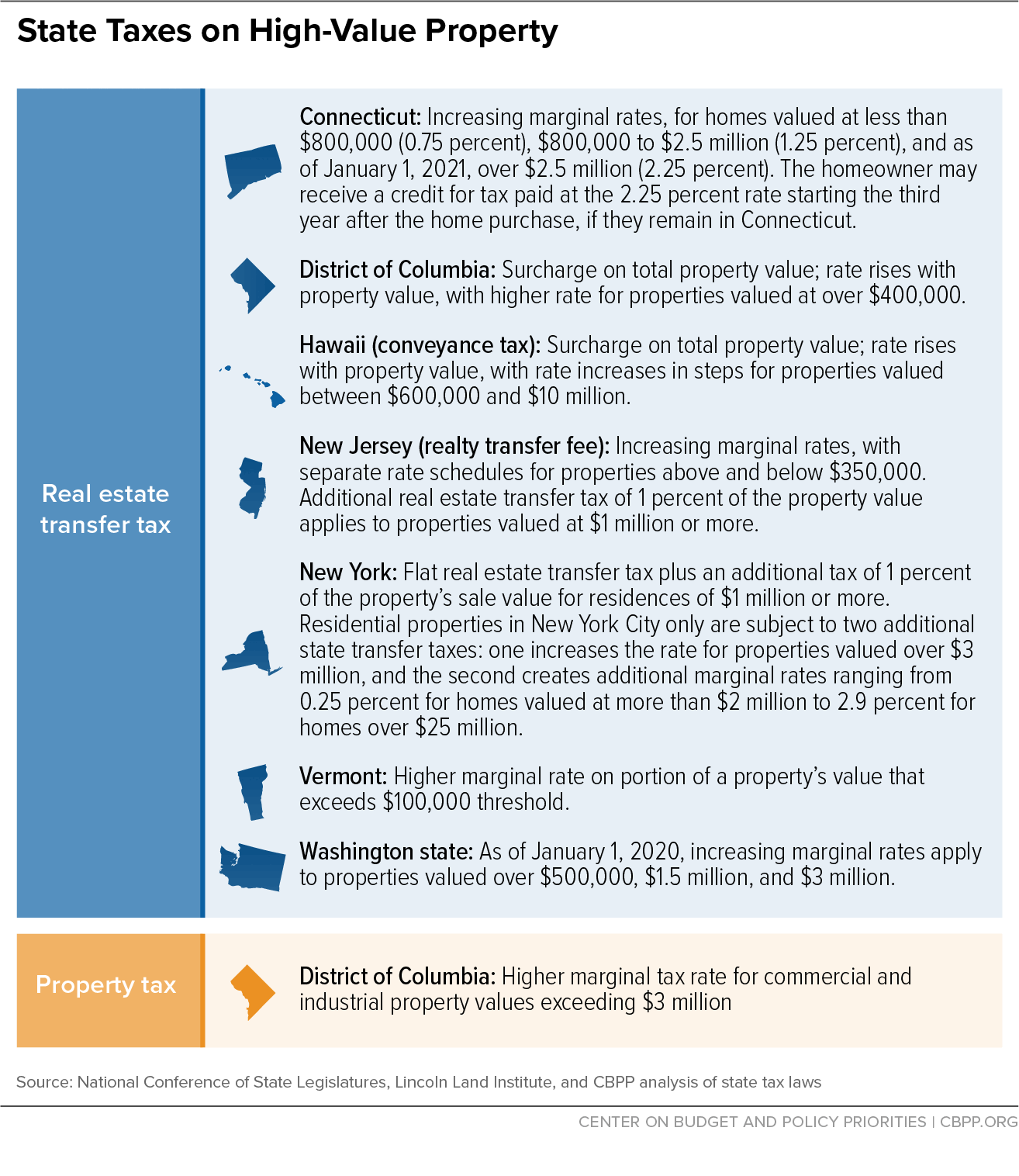

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Nebraska Sales And Use Tax Nebraska Department Of Revenue

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise